You’ve done it. You’ve finally bought that new sofa you wanted so much. The old one is still perfectly good to sit on, so you jump online to try and get a little bit of cash for it.

Every day, thousands of Australians list their unwanted things on online trading sites such as Facebook Marketplace and Gumtree. It’s a fast and convenient option, not to mention it helps us to divert goods from landfill.

Unfortunately, scammers constantly target unsuspecting buyers and sellers. More than A$45 million was reported lost through fraudulent buying and selling schemes in 2022.

The popularity of online marketplaces has made them a fertile ground for fraudsters. There have been recent reports of offenders using these platforms to physically attack those selling goods.

However, it is more likely scammers will try to gain money through payment methods. The PayID scam is a popular example of this, with Australians losing more than $260,000 through this specific approach in 2022.

You’ve done it. You’ve finally bought that new sofa you wanted so much. The old one is still perfectly good to sit on, so you jump online to try and get a little bit of cash for it.

Every day, thousands of Australians list their unwanted things on online trading sites such as Facebook Marketplace and Gumtree. It’s a fast and convenient option, not to mention it helps us to divert goods from landfill.

Unfortunately, scammers constantly target unsuspecting buyers and sellers. More than A$45 million was reported lost through fraudulent buying and selling schemes in 2022.

The popularity of online marketplaces has made them a fertile ground for fraudsters. There have been recent reports of offenders using these platforms to physically attack those selling goods.

However, it is more likely scammers will try to gain money through payment methods. The PayID scam is a popular example of this, with Australians losing more than $260,000 through this specific approach in 2022.

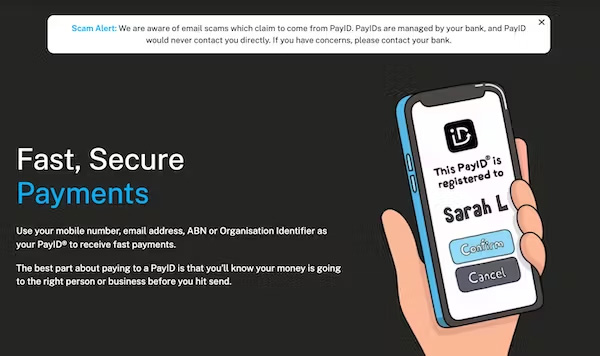

What is PayID?

PayID is a legitimate form of electronic payment introduced in Australia in 2018 to overcome incorrect payments as well as reduce fraud – by showing the recipient’s name to the person making the transaction. It aims to simplify the transfer of money. Importantly, PayID reduces the need to remember bank account and BSB numbers, and overcomes the issue when these are entered incorrectly. To set up a PayID, consumers can use their phone number, email address or ABN as a form of identification. The bank will verify the person owns this information, and then link the person’s bank account to this unique identifier.

Screenshot of the official PayID website. PayID, CC BY-SA

How does the PayID scam work?

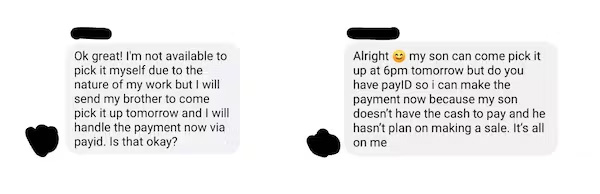

If you’re advertising an item online, a scammer will make contact to purchase the item. They usually will not question the price, and they are unlikely to even want to view the item. In many cases, they will say a family member or friend will collect it from you. The offender will then urge you to accept payment through PayID. Once you’ve shared your PayID (usually phone number or email address) and the scammer has this information, a few things may happen.

Examples of PayID scam messages received via Facebook Marketplace. The Conversation, CC BY-SA

How do I avoid a PayID scam?

There are several warning signs to look out for when selling goods online:- PayID is a free service. There are no costs associated with using it, and therefore no fees will ever need to be paid

- PayID is administered through individual banks. PayID will never communicate directly with customers through texts, emails, or phone calls. Any correspondence which says it is “from PayID” is fake

- a genuine buyer will usually inspect and collect any goods. A buyer who says they will send a family member or friend to collect the item is a red flag, especially if they are unwilling to pay in cash.